As announced on 18 December 2015 and on 28 July 2016, the contract provided for the contribution to the newly established company Slovak Power Holding BV (HoldCo) of the entire stake held by Enel Produzione in Slovenské elektrárne, equal to 66% of the latter’s capital, and governs the subsequent sale in two stages to EP Slovakia BV of 100% of HoldCo for a total consideration of EUR750 million (USD673 million), subject to adjustment based on a set of criteria.

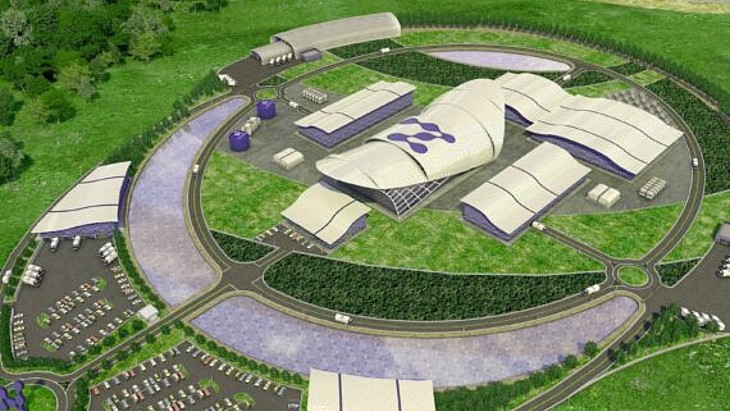

Construction on the two Mochovce units was restarted in 2008 and aimed at having both units in operation by 2013, at a total cost of EUR2.8 billion. This was increased at the start of this month to about EUR6.2 billion. Fuel loading at unit 3 is expected by April 2021 and at unit 4 in 2023.

Based on the new agreement, Enel Produzione and EPH have implemented a number of amendments to the contract, which regard the financial support provided to Slovenské Elektrárne for the completion of units 3 and 4 of the Mochovce nuclear power plant, as well as the mechanisms governing the exercise of the put or call options concerning the transfer of the residual stake in HoldCo.

Enel Produzione will grant, directly or through other companies of the Enel Group, loans to HoldCo - which will in turn make them available to Slovenské Elektrárne - in the maximum amount of EUR570 million falling due in 2032. These loans will be made available in accordance with the needs and timing envisaged for the completion of the construction of Mochovce 3 and 4.

The disbursement of the first loan, of EUR270 million, is subject to certain conditions, in particular the amendment of certain loan agreements between Slovenské Elektrárne and its lender banks, in order to take into account of the progress of the project, and other conditions customary for these kinds of transactions. The disbursement of this first loan is a condition for the effectiveness of the additional amendments to the contract agreed between the parties.

The loans up to EUR570 million are in addition to the loan of EUR700 million already disbursed by the Enel Group in line with the agreements amending the contract signed by the parties in 2018 and whose maturity is also provided to be extended to 2032. The new agreement between the parties also envisages that EPH in turn grants an additional loan of EUR200 million to fund the project.

On the amendments related to the mechanisms governing the exercise of the put or call options, Enel noted a new regulation for the so-called 'trigger events' for which Enel Produzione and EPH can exercise the respective options. The so-called 'long stop date' has been eliminated and therefore the put or call options can be exercised when the latest of the following events occurs: six months from the date of completion of the trial run of Mochovce’s unit 4; the date of completion of the first outage of Mochovce’s unit 4; and, the maturity of the loans set for 2032.

The new agreement also provides EPH with the possibility to exercise an 'early call option' after six months from the signing of the updated contract and until the first of the following events occurs: four years from the completion of the trial run of Mochovce’s unit 4 and December 2028.

The total consideration of EUR750 million is subject to an adjustment mechanism, which will be calculated by independent experts in accordance with a formula already defined in the contract, to which the new agreement provides for a number of amendments, relating to the exclusion of part of the investments envisaged for the completion of Mochovce’s unit 4 and the setting of the percentage of this unit’s enterprise value to be considered depending on when the option is exercised.

In the event of the exercise of the 'early call option' from EPH, a floor and cap of the consideration have been introduced - which will vary depending on when the option is exercised and the effective application of the price determination formula - ranging from a minimum of EUR25 million up to a maximum of EUR750 million.

The new agreement envisages that when the options are exercised, EPH will take over the loans. In the event of the exercise of the early call option, EPH is expected to take over the loans according to a plan starting from 2026, with the last tranche expected in 2032 at the latest.

.jpg)