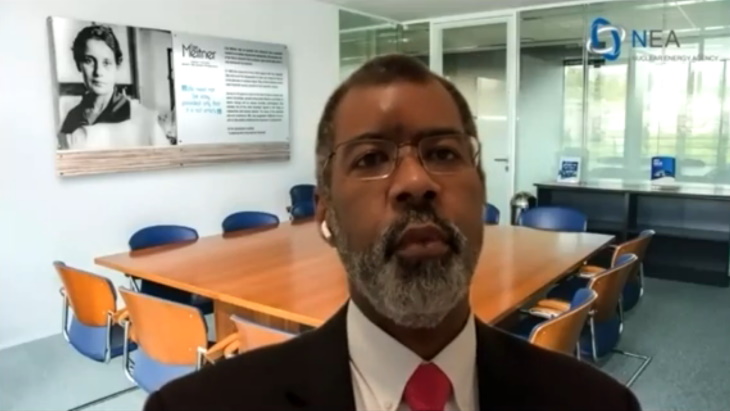

"Countries such as Poland, the UK, the US, Canada; countries that have been building nuclear plants all along, such as China, Russia; and many others around the world including countries that have not built nuclear in the past, countries that are located in the Middle East, Africa, Southeast Asia - they have made the decision that nuclear is part of the future," said NEA Director-General William Magwood. "I think the question today for many countries is whether nuclear is accessible to them in the near term because of the difficulties of financing."

The NEA said it is currently analysing the financing frameworks for nuclear new build in its member countries and in others nations. The key objectives of this study are to review the challenges facing new nuclear financing in NEA countries and to identify good practices in terms of the allocation and management of construction and market-related risks. The study also explores how proposed financing frameworks and policy interventions could best support nuclear new build in today's electricity markets.

Participants in the workshop - titled Issues in the Financing of Nuclear New Build - agreed that investments in long-lived and highly capital-intensive low-carbon technologies, such as nuclear energy, are integrated with long-term societal objectives such as climate change mitigation. As such, they have characteristics that make them similar to strategic national infrastructure investments that have large positive externalities at the system level and therefore require specific linkages between the public and the private sectors.

IFNEC Chair Aleshia Duncan said there is a strong need for governments to be involved in creating well‑performing financing frameworks for new nuclear construction. "I think that is, from my point of view, one of the most overlooked and undervalued pieces of this puzzle," she said.

The participants noted that the overall costs of financing can be efficiently reduced though proper allocation of the different risks pertaining to a new nuclear power project. The most important of these are construction risks and market-related risks. They agreed a core economic principle to follow is that each risk should be borne by the parties best placed to reduce it ex-ante and most capable to absorb any incompressible residual ex-post in the context of their overall strategies of diversifying.

There should also be alignment of incentives among all stakeholders in order to ensure that individual profit-maximising behaviour drives the minimisation of the costs and duration of nuclear new build projects.

"There must be an alignment of incentives among all the stakeholders involved in any nuclear construction project," Magwood said. "The vendors, the owners, the operators, the local stakeholders have to see the project as a whole and have to have an alignment to make sure that their highest priority is the success of the project. And if that is not the highest priority for everyone involved, then you are walking into problems and that is partly including those who would provide financing."

Poland considers options

During his introductory remarks, Adam Guibourgé-Czetwertyński, Poland's undersecretary of state for climate and environment, said the country had identified "a crucial role" for nuclear energy in its future energy mix.

Guibourgé-Czetwertyński giving his opening remarks to the webinar

However, he said one of the most important issues the development of a nuclear power programme currently faces is the availability of adequate and effective financing at reasonable cost. "It is indeed one of the greatest challenges that we face in bringing a new nuclear power plant from the development stage to reliable, safe and economic commercial operation. Without finding the right way to address this issue, there will be no successful nuclear power plant projects, and without nuclear the transition to a zero-emission, clean energy system would be much more difficult."

Guibourgé-Czetwertyński said there are three key factors to financing new nuclear power plant projects. Firstly, the need to deal with the risks during the construction phase. Secondly, the question of how to overcome market failures to enable a reliable and competitive supply of electricity from nuclear power plants in future energy markets. Thirdly, how to successfully deliver these projects on time, at the level of quality expected, to budget and at a reasonable cost.

Poland's nuclear power programme - approved by the government last October - envisages the construction of 6-9 GWe of nuclear generating capacity by 2043. The first unit is expected to be completed by 2033, with the commissioning of the subsequent units every other year over the following decade.

"In terms of financing, we expect going for a programme of 6-9 GWe will allow us to benefit from economies of scale by building consecutive units using the same technologies and with the same partner, allowing us to optimise the costs of these investments." He added, "We expect the technology vendor or the members of the consortium to also become co-investors in this project."

The technical workshop was the first of a series of workshops designed to assess the state of nuclear financing and examine a number of key issues at a conceptual level. The NEA said several topical webinars will follow in the coming months which will explore specific issues related to international co-operation in the area of nuclear finance, including nuclear financing in embarking countries, exploring the role of multinational banks, export credit agencies, and other international financial institutions. This series of events will be concluded with a high-level conference to be hosted by Poland at the end of 2021.

_18570.jpg)

_16159.jpg)

_49205.jpg)