Cameco has announced two moves to establish itself as a major uranium supplier to a booming Chinese nuclear fuel market featuring long-term contracts for the first time.

|

| CNNC headquarters in Beijing |

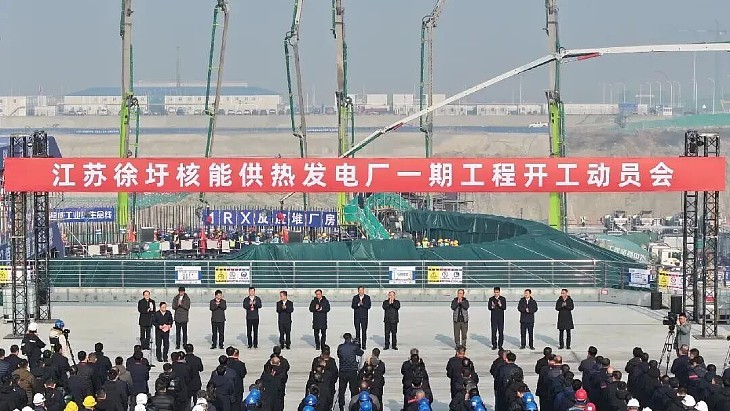

CNEIC is a subsidiary of the giant China National Nuclear Company (CNNC), which has seven reactors in operation and nine more under construction. CNNC also owns a major stake in CGNPC, which has four reactors in operation and 13 under construction. Between them the companies plan to take Chinese nuclear generating capacity from the current 9 GWe to as much as 160 GWe in 2030.

Jerry Grandey, CEO of Cameco, said that the supply deal with CNEIC "indicates clearly that we intend to be very active in the world's fastest growing uranium market." He said he hoped talks with CGNPC would result in a "long-term relationship." Grandey wants Cameco to double its uranium production by 2018. In line with current restrictions on trade in uranium between Canada and China, Cameco will be sourcing the uranium from elsewhere. Aside from Canada it has uranium mines in the USA and Kazakhstan.

Until now Chinese firms have not been permitted to make long-term uranium supply deals and have instead supplemented equity stakes in uranium mines with purchases on the spot market.

CNNC currently requires about 4.3 million pounds of uranium oxide per year so the Cameco deal equates to roughly five years of current demand. However, before the end of the agreement in 2020 CNNC will probably have more than triple its current capacity, while first cores for its new reactors will require more than double the amount of uranium as subsequent refuellings.

Researched and written

by World Nuclear News

_28178.jpg)

_66891.jpg)

_16128_62584.jpg)