Energy leaders at the annual meeting of the World Economic Forum (WEF) meeting in Davos, Switzerland, have debated whether low oil prices could slow investment in new fossil fuel supplies, as well as in alternative energy supplies. The head of EdF suggested now is the time to invest in nuclear energy.

The current price of oil is about $40 per barrel, in sharp contrast to the record-high of almost $150 per barrel in July 2008. Among oil producers, the major question is whether current cuts in production will be sufficient to keep oil prices from declining further. Ilham Aliyev, President of Azerbaijan, said that they will be sufficient to stabilize prices. However, Abdalla Salem El Badri, Secretary-General of the Organization of the Petroleum Exporting Countries (OPEC), reiterated his intention to review current production numbers at the OPEC meeting on 15 March. His goal is a return to oil priced at $60 to $80 a barrel.

The view from oil producers is that current oil prices, while low enough to stimulate the economy, are too low to support the income needs of producing countries while simultaneously providing for new investments in energy production and infrastructure - investments that the global economy will quickly require when it recovers.

"We are not happy with even $50 [a barrel] oil," said El Badri, adding, "We don’t want a repeat of the 1980s when we didn't invest, had to lay off high-skilled people, didn't invest in new capacity. We have to be ready to meet rising demand."

Tony Hayward, group chief executive of BP, said that a market price of oil between $60 and $80 per barrel would allow OPEC countries to make investments that will guarantee future energy supplies beyond the current economic downturn, after which demand is expected to rise. He said, "The most important thing is the ability to invest through the downturn."

Time to invest in nuclear

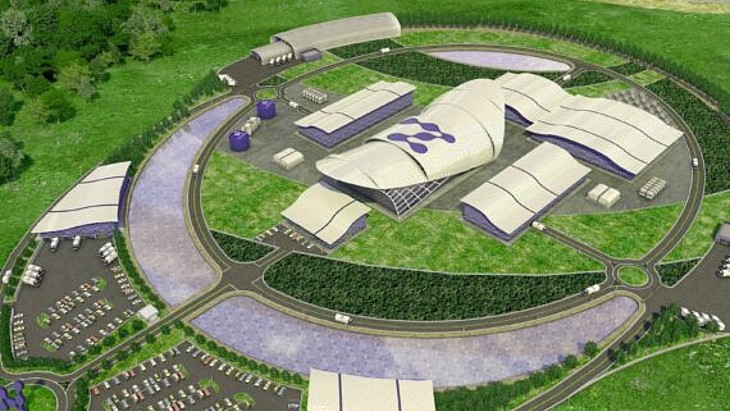

Pierre Gadonneix, chairman and CEO of Electricité de France (EdF), said that current economic downturn is the right time to invest in alternatives to oil and gas. This should include nuclear power, he said.

Gadonneix said, "The long-term prospective of the energy sector has nothing to do with the economic downtrend that we are living now. All of us know that the economy will start again. Nobody knows if it will be in months or years. But we know that it will start again."

"The energy needs that I mention are really there. So we should invest. And I think all this analysis is a very good environment for the renewal of nuclear. And clearly, my company EdF is bound to play a major role in the renewal of nuclear in France, in Great Britain, in China, and maybe in the United States," he added.

However, Gadonneix acknowledged that nuclear energy needs to find greater public acceptance to achieve a larger role in global energy production.

Low oil prices could harm future energy supplies

Energy leaders at the annual meeting of the World Economic Forum (WEF) meeting in Davos, Switzerland, have debated whether low oil prices could slow investment in new fossil fuel supplies, as well as in alternative energy supplies. The head of EdF suggested now is the time to invest in nuclear energy.