Mid-year reports from two Canada-based uranium producers share an air of quiet optimism despite feeling the effects of events in Japan.

|

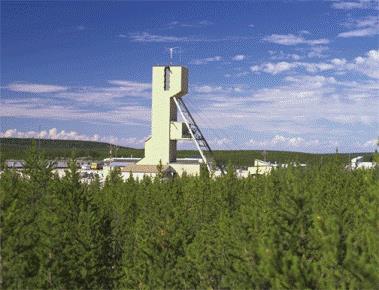

| Cigar Lake (Image: Cameco) |

Cameco, which regained its position as the world's largest uranium production company in 2010, and Denison both reported half-yearly earnings that were down on the same period last year, with Cameco reporting net earnings of C$145 million ($146.3 million) and Denison a net loss of nearly $14 million for the period.

Vanadium and uranium producer Denison pointed to events in Japan as the reason for a decline in spot market uranium demand and price. The company has responded to the weaker market conditions by deferring uranium sales until later in the year.

Cameco, which also has interests in electricity generation and nuclear fuel services, saw lower earnings across all three sectors. Earnings from the uranium sector were down due to lower sales and an increase in the average cost of product sold, although this was partly offset by an increase in the realised price.

Cameco's results were also affected by lower uranium sales volumes, although the company says it expects sales to be heavily weighted towards the second half of the year, expecting deliveries in the fourth quarter to account for about a third of the year's total sales volumes.

Production plans

The first half of the year saw Denison produce 679,000 pounds U3O8 (261 tonnes U). Even before the events of 11 March, Denison had revised its uranium production forecast for 2011 downwards to 1.2 million pounds U3O8 (462 tU). This figure remains unchanged despite revisions to Denison's ore processing plans for the remainder of the year subsequent to its acquisition of uranium exploration and development company White Canyon, including the Daneros mine in Utah.

Cameco's first-half uranium production totalled 10.5 million pounds U3O8 (4039 tU), 4% down on the same period in 2010 due to planned variations in mill production at Rabbit Lake. The company reports that uranium production is on track for the year at both McArthur River and Key Lake in Canada, although sulphuric acid supply problems had a small impact on production from its interests in Kazakhstan. The company is exploring alternative sources of sulphuric acid supply but warns that this year's total production could be affected if acid supply remains an issue.

Work at Cameco's major Canadian development site, Cigar Lake, is continuing, with the company expecting to reach the main mine workings on the 480-metre level by the end of the year. Initial production is planned for mid-2013.

Counting the cost

Cameco has considered the likely knock-on effects of the 11 March earthquake and tsunami on the Fukushima Daiichi nuclear power plant for its business, and reviewed its supply and demand outlook accordingly. It has revised its estimates to take account of Germany's decision to reintroduce a nuclear power phaseout and the current status of the Japanese nuclear fleet.

Specifically, Cameco anticipates a slight decrease of about 3% in total world uranium demand over the next decade. Annual global uranium consumption over the period, estimated at about 225 million pounds U3O8 per year (86,545 tU) is lower than in its previous estimates, although continuing to grow at about 3% per year. The company has cut its estimate of new reactors coming on line by 2020 to 85 from the 90 predicted in previous estimates.

Nevertheless, Cameco expects annual global consumption to continue to exceed annual global mine production "by a significant margin" over the next decade, and says it is well placed to help meet the challenge. "With our extensive portfolio of long-term sales contracts, we are in the enviable position of being heavily committed until 2016, which provides us with financial stability as we pursue our corporate growth strategy," according to Cameco president and CEO Tim Gitzel.

Researched and written

by World Nuclear News

_83010.jpg)

_33198.jpg)

_730_93825.jpg)