The UK's National Audit Office (NAO) has today published a report on the government's support for Hinkley Point C, which it calls a "risky and expensive" project. The report makes recommendations for how the government now oversees the project and how it agrees deals for other major infrastructure projects.

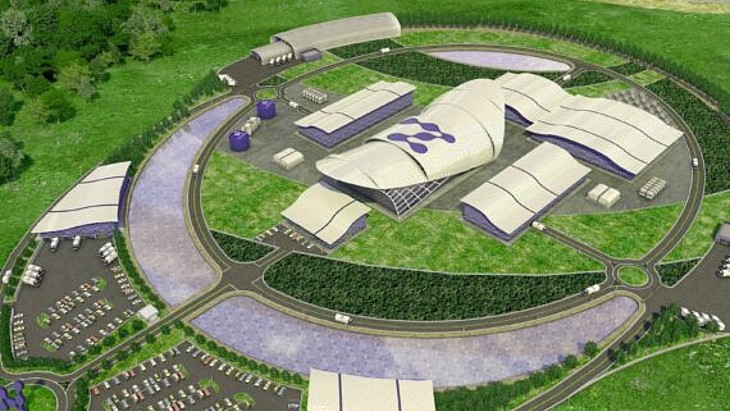

Consisting of two European Pressurized Reactors, Hinkley Point C in Somerset, England will be the first new nuclear power station to be built in the UK in almost 20 years and will provide about 7% of the country's electricity. The first unit is expected to be commissioned in 2025-2026.

The project received a long-awaited and positive final investment decision from the EDF board in July 2016, only for the UK government to immediately postpone signing its supporting agreements. Last September, the government announced its approval of the project. The contract-for-difference (CfD) based on a strike price of £92.50 ($117.80) per MWh - agreed with the government in 2013 - was confirmed. The strike price was based on the cost estimate for the project of £18 billion.

The NAO scrutinises public spending for Parliament. Its public audit perspective helps Parliament hold government to account and improve public services.

The NAO has now published a report assessing the Department for Business, Energy and Industrial Strategy's (BEIS's) case for its deal to support the Hinkley project, its approach to reaching the deal, and its arrangements for managing remaining risks to electricity consumers and taxpayers.

The report notes that the current structure of the deal means that the costs of the project - which it suggests has "uncertain strategic and economic benefits" - will be met by electricity consumers rather than taxpayers. The NAO said, "A failure by government to assess the impact of its policies on consumers could lead to consumers facing financial hardship, and unplanned taxpayer support being required. We have therefore considered the financial impact of the deal on consumers as part of our conclusion on value for money."

According to the NAO, when BEIS finalised the deal in 2016 its value for money tests showed the economic case for the project was "marginal and subject to significant uncertainty". It said, "Less favourable, but reasonable, assumptions about future fossil fuel prices, renewables costs and follow-on nuclear projects would have meant the deal was not value for money according to the Department's tests."

The NAO says BEIS "only considered the impact on bills up to 2030, which does not take account of the fact that consumers are locked into paying for Hinkley Point C long afterwards". It also did not conclude whether the forecast top-up payments are affordable.

The NAO says the government's case for the project has weakened since key commercial terms for the deal were agreed in 2013. "The Department's capacity to take alternative approaches to the deal were limited after it had agreed terms," it claims.

However, the report notes that BEIS has negotiated a deal that means some terms "can be adjusted in consumers' favour in future". The NAO says BEIS must now "ensure it has the right oversight arrangements in place to manage the contract in a way that maximises Hinkley Point C's value for consumers and taxpayers".

"The Department has committed electricity consumers and taxpayers to a high cost and risky deal in a changing energy marketplace," said NAO head Amyas Morse. "Time will tell whether the deal represents value for money, but we cannot say the Department has maximised the chances that it will be."

Nuclear Industry Association chief executive Tom Greatrex said, "Today's report confirms that Hinkley Point C is competitive with other low carbon projects and recognises that nuclear has both a part to play in the lowest cost decarbonisation of our power supply, and that alternatives would cost more."

He added, "While, as with other technologies, follow on projects will cost less, the NAO analysis of the strike price also highlights that using a different financing structure could have resulted in a lower strike price. That is something government should reflect on as other new nuclear projects advance."

Researched and written

by World Nuclear News