The UK government has unveiled a set of reforms to its liberalised energy market that should encourage strong investment in all forms of low-carbon power.

|

| Energy minister Charles Hendry taking questions on energy market reform yesterday (Image: DECC/Nick Clarke) |

Britain wants to decarbonise its power sector and increase security of supply after a period of little investment and reliance on domestic gas. The white paper said: "Electricity prices and bills could rise slightly in the short term but over the long term, costs to business and to the consumer will be lower than without reform." The UK has binding carbon budgets to reduce emissions to 34% of 1990 levels by 2020, and 80% by 2050. These are based in part on a landmark report by Sir Nicholas Stern who concluded that strong early investment would be the most economic way to approach climate change.

Four proposals make up the meat of the white paper: a carbon floor price; feed-in-tariffs with a 'contract for difference' to stabilise financial returns from low-carbon generation; an Emissions Performance Standard to prohibit the construction of high-carbon generation; and mechanisms to ensure the provision of sufficient generating capacity nationwide.

Of these, the last was the least fully formed. The government acknowledged that it had received much advice on the pros and cons of capacity payments. It will decide on the mechanism for the payments at the end of the year.

The white paper was generally well received, and welcomed by the Nuclear Industry Association and the major nuclear generator in the country, EDF Energy. The head of that firm, Vincent de Rivaz, said the policies would "balance the needs of customers, policy makers and investors in a strategy to deliver secure, clean and affordable energy."

The carbon floor price had long been seen as fundamental to the economics of new UK nuclear power, with the EU's Emissions Trading Scheme not producing high enough prices to steer markets towards low-carbon power. The UK government will ensure the price is a minimum of £16 ($25.7) per tonne of carbon dioxide from 2013, with this set to rise steadily to £30 ($48.2) per tonne in 2020 and accelerate to £70 ($112.5) per tonne in 2030.

RWE npower, which is a 50% partner in the Horizon Nuclear Power joint venture, but currently a non-nuclear generator, complained that the price would harm industry. "The mechanism acts in a similar way to a tax, and like a tax it is unlikely to change behaviour," said the firm in a quick reaction to the white paper. "The mechanism can easily be changed by subsequent governments, thus long-term investment decisions are unlikely to be influenced by it."

RWE npower also called for clarity on the feed-in tariffs with contracts for difference (FiT CfD). These are meant to adapt to long-term power prices, as could be dictated by the prices of gas or carbon, and ensure stable and predictable returns without leading to excessive profit for generators.

It's a two-way FiT CfD, OK?

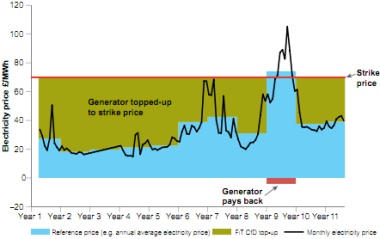

This new support mechanism is based around a 'strike price' for electricity for the duration of a contract between the generator and the government. If market prices are below the strike price, the government will make up the difference, thereby assuring predictable revenues to investors in financially risky new generation projects. However, when market prices are above the strike price it is the generator that must pay back to government.

|

An illustration of how FiT CfD could work for baseload generators |

The white paper said the end result would be that "as the carbon floor price gradually increases the wholesale electricity price, the support needed for low carbon generators is reduced."

Two types of CfD will be used: baseload generation will be assessed on average annual power prices, with intermittent generation assessed on monthly prices.

The white paper said, "These long-term contracts will provide greater revenue certainty to investors in all forms of low-carbon generation, and remove exposure to the volatile gas price, leading to a lower cost of capital for low-carbon generation." But RWE npower called for clarity on most of the details - strike price, length of contract, and the source of the market prices among other things - noting that none of these will be specified until later in the year.

Backstop

The Emissions Performance Standard is being called a 'regulatory backstop' to the other measures. It sets the level of 450 grams of carbon dioxide per kilowatt hour as a limit under which new fossil plants must operate. This level is enough to rule out new coal plants unless they are able to capture and store their carbon, while gas power plants would come in under the standard.

Researched and written

by World Nuclear News

_97013.jpg)