Nuclearelectrica owners approve China agreement

The shareholders of Romanian national nuclear company Nuclearelectrica have approved an agreement with China General Nuclear (CGN) to develop two units at the Cernavoda nuclear power plant. Nuclearelectrica said on 22 October that the November 2013 document had been approved at an extraordinary general meeting.

Nuclearelectrica says on its website that its ownership is split between the Romanian energy ministry, with 82.48%, Romanian investment fund Fondul Proprietatea, with 9.10%, and 'other investors', with 8.42%. Fondul Proprietatea has been trading on the Bucharest Stock Exchange since January 2011.

Romania and China signed a letter of intent in November 2013 during a visit to Bucharest by Chinese premier Li Keqiang. During his visit, the two countries sign numerous bilateral agreements, including a memorandum of understanding (MOU) on the peaceful uses of nuclear energy. The Romanian government approved the MOU on 2 September, Nuclearelectrica said.

Nuclearelectrica said the MOU is part of the government's strategy to continue the Cernavoda 3 and 4 project by organizing an "investor selection procedure", which Nuclearelectrica's shareholders approved in August 2014. It added that approval of the MOU "establishes the direction of future cooperation" between Nuclearelectrica and CGN in acknowledging the Chinese company's capacity as an investor capable of developing the project.

Daniela Lulache, Nuclearelectrica CEO, said the Cernavoda project is a priority investment decision for the Romanian state since it will "on the one hand, ensure long-term security of supply, energy independence, a balanced and stable energy mix capable of meeting de-carbonization targets; and, on the other hand, enhance the value of Nuclearelectrica's assets and improve its financial growth".

Nuclearelectrica and CGN can now proceed to the next stage of their cooperation, Lulache said. That will involve, she said, negotiating and completing an Investors Agreement and Articles of Incorporation, with a view to setting up a new project company for the construction and completion of Cernavoda 3 and 4.

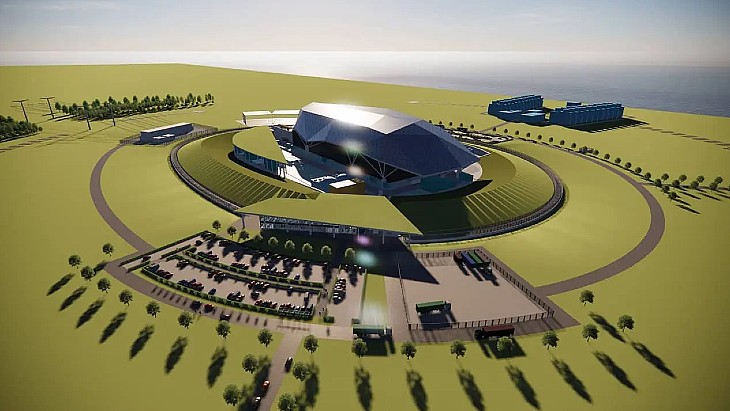

Cernavoda is home to two operating Candu 6 pressurized heavy water reactors supplied by Atomic Energy of Canada Ltd and built by a Canadian-Italian consortium of AECL and Ansaldo. Unit 1 started up in 1996, but work was suspended on a further four units in 1991. Unit 2 was subsequently completed and has been in operation since 2007.

Efforts to resume work on Cernavoda 3 began in 2002, and a new project company, EnergoNuclear, was established in 2009 to oversee the completion of units 3 and 4. Initial partners GDF Suez, CEZ, RWE Power and Iberdrola subsequently withdrew, and the company is currently 84.65% owned by Nuclearelectrica. The Romanian state has since then been looking for new investors in the project to enable Nuclearelectrica to reduce its share.

CGN said in late 2013 that the agreement with Nuclearlectrica signalled a new step in its aims to "go global", following a letter of intent signed with EDF in October that would see it take a share the planned Hinkley Point C nuclear plant in the UK.

Last week, CGN agreed to invest £6 billion ($9 billion) in EDF Energy's project to construct the Hinkley plant. Under a Strategic Investment Agreement, EDF's share in the project will be 66.5% and CGN's will be 33.5%. CGN will make its investment in the UK through its new company called General Nuclear International.

In a separate statement, Lulache rejected claims by Greepeace's Romanian branch that the Cernavoda project would lead to higher bills for electricity customers. The environmental group has claimed that end-consumers would have to pay an extra 18% for electricity during the operating life of the new planned reactors.

But Lulache said a feasibility study carried out in 2012 by consultants Ernst & Young had supported the cost-effectiveness of the project. "The study concluded that the net present value of the shareholders' investment is positive, that the net present value of the project's cash flow is positive and that the shareholders' internal rate of return is greater that the estimated weighted average cost of capital," Lulache said.

"Greenpeace's strategy is to alarm the public about additional costs to their electricity bill in order to justify their anti-nuclear position," Lulache said, adding that the group's arguments "do not reflect the economic and financial reality" of the Cernavoda 3 and 4 project.

Researched and written

by World Nuclear News

_92619.jpg)

_84504.jpg)

_88592.jpg)