Serial reactor construction key to lowering costs

Developers of new nuclear power plant projects in the UK agree that an experienced supply chain, together with a stable reactor design, will be key to significantly driving down construction costs, delegates heard at the Global Nuclear Investment Summit held yesterday at London's Guildhall. The event was hosted by global nuclear energy financial services provider Ocean Nuclear and the Financial Times.

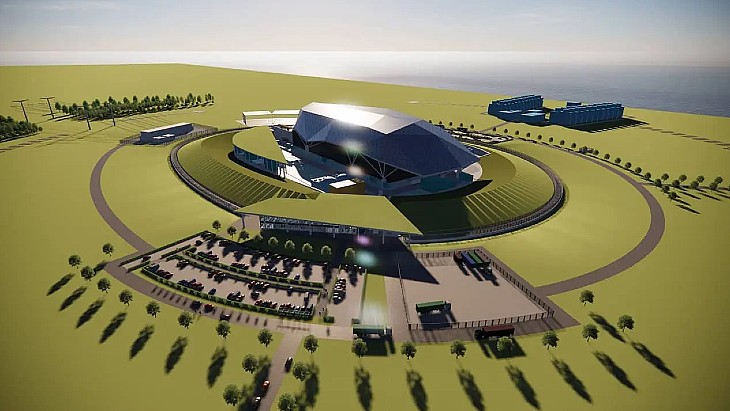

Under a strategic investment agreement signed in October 2016, China General Nuclear (CGN) agreed to take a 33.5% stake in EDF Energy's Hinkley Point C project in Somerset, as well as jointly develop new nuclear power plants at Sizewell in Suffolk and Bradwell in Essex. The Hinkley Point C and Sizewell C plants will be based on France's EPR reactor technology, while the new plant at Bradwell in Essex will feature the Hualong One design.

Robert Davies, chief operating officer at CGN UK, told the event that the focus should be on how the industry can best deliver new nuclear in the UK. CGN, he said, has identified four key issues in keeping down the cost of constructing new nuclear power plants. Firstly, the design of a plant should be fixed. Secondly, you should use experienced engineering, procurement and construction contractors, as well as develop an experienced supply chain. Costs are also reduced by buildings lots of units, he said. Referring to a study by the OCED, he said if you build six units, the price of the sixth unit will be 60% less than that of the first. Fourthly, he said the price should be fixed or capped.

"The secret for nuclear is that we need to build a series and the series needs to be identical copies and you need to help your supply chain improve productivity step by step."

Humphrey Cadoux-Hudson,

EDF Energy

Davies noted that at the Fangchenggang site in China, where two demonstration Hualong One units are under construction, every contract there was at a fixed or capped price. "That makes a big difference to the risks of the project."

Humphrey Cadoux-Hudson, managing director of Nuclear Development at EDF Energy, said there are two "big levers" for making nuclear more cost competitive. One is the cost of construction and reductions created by constructing one unit after another. He said there has been "strong experience" of doing that in China, Korea and Japan. The other lever is to drive down the cost of finance.

"Given that a nuclear plant is a complex machine and the most obvious way of cutting the cost of nuclear is to make identical copies, this is what we plan to do for Sizewell C, an identical copy of Hinkley Point C." He said that this should reduce costs by some 20%. Making a copy will also reduce risk as well as drive down the cost of capital, he added. "If you make a copy, you don't have to do design all over again."

He noted there have been a number of design changes to the Hinkley Point C EPR compared with the one at Taishan in China, in order to meet UK requirements. This has essentially made Hinkley Point C a first-of-a-kind project, which will be able to learn lessons from the Taishan project, as well as from the EPR projects at Olkiluoto in Finland and Flamanville in France, he said.

"For a first-of-a-kind, you end up going into construction at a time when you are still finishing off the design. That is why I am very clear about Sizewell C. It's going to be a copy - as close as we can possibly make it - of Hinkley Point C so that we have the design fully complete before anyone goes anywhere near starting construction on the site. That's what we need in order to help do the next phase of improvement, to get the supply chain to learn and think very hard about how to improve productivity and reduce the cost of construction."

Davies agreed, saying that CGN is following the same "industrial rules" as EDF. "We want to go Hinkley-Sizewell-Bradwell. It may be a different design, Bradwell, but since most of the risk in a nuclear power plant rests in construction - in the civil and the erection part - that has great similarities, being able to train and teach the supply chain to do it and for them to know there is a pipeline of activity and that is how you reduce risk."

Earlier this week, the UK government raised the possibility of a public investment in new nuclear plants in the country. On 5 June, it was announced that Japan's Hitachi - owner of Horizon Nuclear Power - and the UK government have decided to enter negotiations on Horizon Nuclear Power's proposed Wylfa Newydd project. In a statement to Parliament, UK Business and Energy Secretary Greg Clark said actions the government is taking will support a "long-term pipeline" for new nuclear projects in the country.

Cadoux-Hudson welcomed this move, saying it is a "step forward to bring down the cost of capital". He added, "We are looking at an environment for Sizewell C in which the risk is much lower than it was for Hinkley Point C. If we have four operational EFRs - if we have Hinkley Point which is half-way through its construction by the time we come to make a decision on Sizewell - we believe that the risk profile is much lower."

Researched and written

by World Nuclear News

_92619.jpg)

_84504.jpg)

_88592.jpg)