Constellation rejects loan guarantee terms

American plans for new nuclear were hit by uncertainty after Unistar partner Constellation declared the terms of loan guarantees flawed, unrealistic and unworkable.

The news came in a letter from chair of both Unistar and Constellation Michael Wallace to the US Department of Energy. Addressing deputy secretary Dan Poneman, Wallace said the company does not see a path "to reaching a workable set of terms and conditions" for the guarantee of about $7.5 billion in private loans.

The money is required to build an Areva EPR unit at the existing Calvert Cliffs nuclear power plant and Unistar would raise this from private financiers. However, the US government's conditional offer to guarantee the loans is pivotal to securing the finance package. One other nuclear project has already been awarded loan guarantees - Vogtle in Georgia - while several others are vying for the limited pot of assistance.

In a blow to Calvert Cliffs that puts a dark cloud over US new build plans, Constellation has revealed that the DoE would charge fees of 11.6% of the loan amount - in its case some $880 million. The charge would come in addition to interest on loans and, Wallace said, "would clearly destroy the project's economics, or the economics of any nuclear project for that matter."

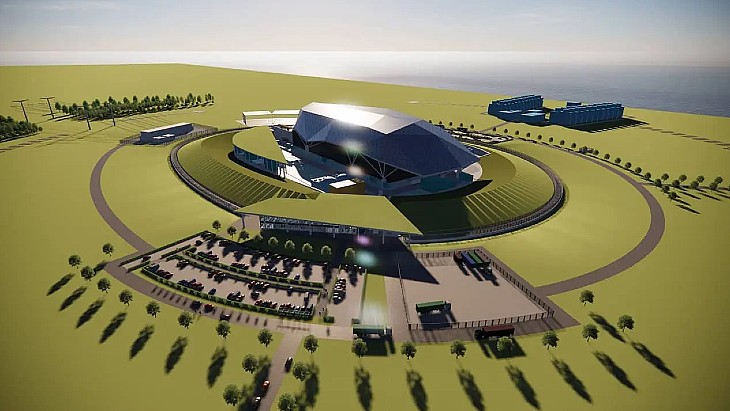

Michael Wallace Chair of Unistar

|

The letter was from Constellation and meant only to represent its own view, while the other Unistar partner, Electricité de France, is aware of the situation but has not commented. No official decisions regarding the future of the project have yet been made and the matter will go before the Unistar board.

Wallace praised the DoE's Loan Guarantee Office but complained that a separate department, the Office of Management and Budget (OMB), was unable to "address significant problems with its methodology for determining the project's credit subsidy cost."

Despite efforts to engage with the OMB, Constellation said it "encountered significant delay and resistance." Wallace painted a picture of a sub-section of the DoE that had taken a position threatening to the entire loan guarantee program, originally designed in 2005 to reduce risks for investment in infrastructure called for by US policy.

President and CEO of the Nuclear Energy Institute Marv Fertel said: "It is vitally important that credit costs be calculated accurately. If current practices continue, the DoE and OMB will continue to produce inflated credit costs." The current formula relies on standard assumptions applied to all technologies with limited project-specific flexibility, said NEI. "The Calvert Cliffs 3 project was quoted an unrealistically high credit subsidy cost, which ignored the project's strong credit metrics and the robust lender protections built into the transaction."

Without reform, Fertel concluded, the methodological fault "will continue to hamper both nuclear energy and renewable energy project development - exactly the opposite intention of Congress when it passed the 2005 law."

Researched and written

by World Nuclear News

_92619.jpg)

_84504.jpg)

_50521.jpg)