The reduction of electricity demand in 2020 gives an insight into the impact of what increased renewable capacity might look like.

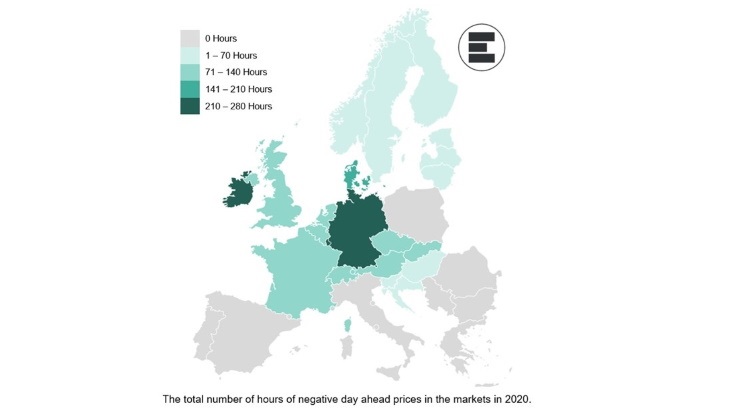

Markets with high wind generation such as Ireland, Germany and Denmark have been particularly affected by negative pricing as peak levels of wind output started to outpace the COVID-19-influenced levels of demand for power consumption. Belgium has also seen particularly low prices as the combination of high nuclear and solar generation have at times oversupplied the market during periods of low demand.

"It is here that we see one of the key challenges of renewables: their intermittency. Where the average output of a solar panel over a year might be 8% or the average output of a wind farm is around 30%, the peak output values will be very close to 100% of the potential output," Alena Nispel, business analyst at EnAppSys, said.

"The levels of demand for electricity are similarly intermittent. In the past it was possible to pair intermittent demand for electricity against a non-intermittent supply of generation (coal/gas power stations) but pairing an intermittent supply (wind and solar) against an intermittent demand creates challenges," she added.

Electricity storage can act to reduce these impacts, at least as far as it is economically sensible to do so, she said, and new technologies such as synchronous condensers can help to reduce the generation required from conventional power sources.

Countries in which renewable generation makes up only a small part of the overall power mix - such as Poland - tend to operate in a less volatile market, according to the study.

_53514_33880.jpg)

_91467.jpg)