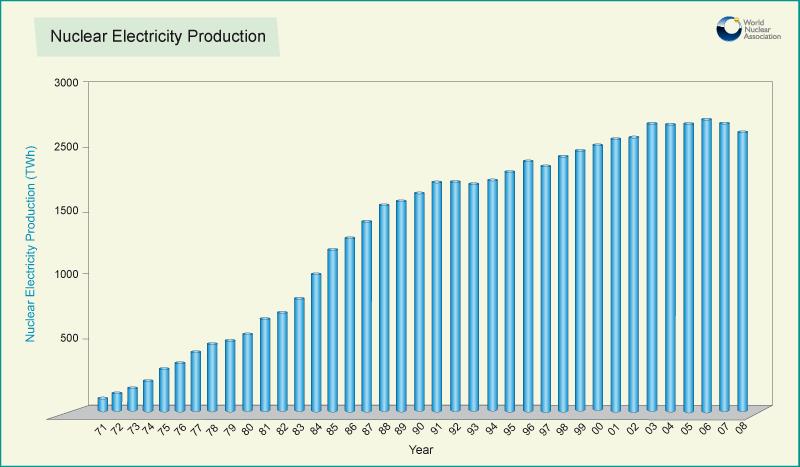

Nuclear power plants provided 2601 billion kWh during 2008. This lowest figure for five years drops its contribution to world electricity supplies to an estimated 14% a few years ahead of a new wave of nuclear build.

The drop from recent years' 16% share is due in part to the extended shutdown at Japan's Kashiwazaki Kariwa plant, the largest in the world which accounts for over 2% of global nuclear capacity alone. Six of the site's seven reactors have been out of action since the Niigata Chuetsu offshore earthquake of 16 July 2007. The seventh unit restarted only this month and it is still not clear when the others will follow.

|

| Despite levelling off, nuclear power is set for a growth spurt that could be as dramatic as that in the 1980s. (Click to enlarge) |

The figures for 2008 come from a combination of International Atomic Energy Agency statistics and World Nuclear Association research, and include the 14% share as an estimate for the year. This sudden drop is sure to be reversed with the effects of the financial crisis. Flexible but more expensive fuels such as gas that are used to meet peak loads are immediately reduced on drops in demand, while bulk low-carbon sources such as nuclear power and large hydro continue to supply at their usual levels.

Renaissance in earnest from 2013?

No new reactors started operation in 2008, but construction did begin on ten units, indicating that the same number could be completed per year from around 2013 as visible results of the global push for more nuclear power.

Construction starts in 2008 came in China (six units), Russia (two) and South Korea (two). The extensive new build programs in China and Russia are well funded and supported, and China is proposing to accelerate build rates year on year into the middle of the century. Given that India is preparing a major push for new build at the same time as countries such as Italy, the UK and the USA, the 2013-2018 timeframe is expected to see the start of many new construction projects.

Decisions in Argentina, Brazil, Slovakia, Romania and the USA to complete stalled nuclear projects first in line with simple economics will see more reactors enter operation in the nearer term. In addition, of course, will come large reactors in Finland and France, as well as two in Japan, two in India, five in Russia and some 12 in China that are all due for completion around 2013.