How has Orano managed the disruption caused by COVID-19 and what are the lessons learned from the strikes at the Malvési conversion plant?

Given the situation in Wuhan we decided as soon as January 2020 to revisit our activity continuity plan, that had been set to face unexpected events, around three domains: preserve the health of people working on our sites; keep a high level of nuclear safety; and ensure the continuity of all essential activities required for the production of electricity in France and abroad. This crisis is not over yet and stepping back from this specific event I am convinced that being prepared to manage low-probability risks with high consequences is a must today.

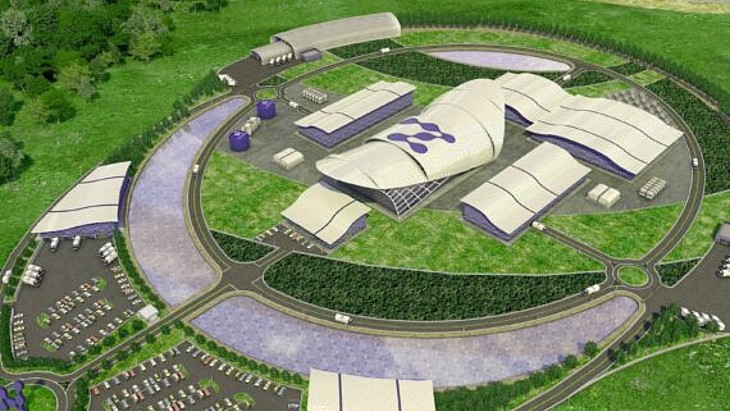

Facing a combination of industrial adjustments in ramping-up Philippe Coste production and of local social tension in Malvési, the 2020 production level was limited to 2640 tonnes of UF6. The Philippe Coste conversion plant runs according to plan this year, with a monthly production exceeding 1000 tU, and I feel confident that Philippe Coste can achieve production above 8000 tonnes this year.

What is the timeline for ramping up the Philippe Coste plant and what is the breakdown of capacity during and at the end of that period?

The project phase is over now and production is gradually increasing to reach the nameplate capacity of 15,000 tonnes in 2023.

What was the thinking behind the restart of the conversion plant in the USA and what will it mean for the global conversion market? Do you expect any changes in utilities' buying behaviour after the conversion market becomes re-balanced again in 2023-2024?

I am not going to comment on the decision of one of our competitors but I can say that, despite this restart, conversion supply and demand are fairly balanced. During the Philippe Coste ramp-up, I have learnt that conversion is the most complicated facility of the front-end fuel cycle and even with undisputable operating experience it is not an easy matter to start up such a facility.

What are the key trends in supply/demand for U3O8, UF6 and EUP (enriched uranium product)?

Looking ahead across all front-end businesses, there is positive news. In the long term, worldwide electricity demand is to double by 2050 whilst carbon emissions need a twofold reduction. This factor is a real challenge, and nuclear energy is year after year better recognised to fill a significant part of this gap. Whatever the type of reactors which will be developed and built, this will have an impact on front-end demand for U308, UF6 and EUP. By way of example, how should uranium producers dedicate the necessary exploration budget to pave the way to additional resources given the current market environment? I am proud to say that Orano has dedicated the highest exploration budget among all players over the past years.

The challenge for enrichers is also a financial one. Enrichers do face the combination of capacity replacement of ageing centrifuges, the overall generation capacity increase and the additional efforts needed to produce HALEU. Clearly the investments in new cascades and centrifuges will not happen at a time when market prices do not sustain additional investments.

What are your plans and expectations for supplies of HALEU in light of accident tolerant fuels and new fuels for SMRs that are rapidly developing nowadays? Where are the constraints to transportation and delivery, regionally and globally? Do you see any challenges in the regulatory regimes?

We are currently focusing on producing uranium enriched up to 6% by the end of 2023 and higher assays will follow. With our logistics subsidiary, Orano TN, we are working actively to unlock the current constraints of transportation for deliveries. This topic is common to all the industry. Regarding production plans for HALEU up to 20%, interest from small modular reactor developers is flourishing. Building the HALEU supply chain is a project on its own. Therefore, the industry needs to work together with all stakeholders to establish a sustainable business model in order to allow the decision by front-end suppliers to invest. If so, Orano has the technical capability and is ready to invest.

I have full confidence in our industry's ability to build the solutions for the nuclear of the 21st Century.

What does nuclear energy's role in the clean energy transition mean for the conversion and enrichment market?

As mentioned previously, the increase in electricity production to fight climate change will be tremendous. But you need to produce decarbonised electricity. France produces six times less CO2 per kilowatt-hour than Germany. Nuclear will play a key role in this regard. At Orano, we are very confident in the development of nuclear and for this reason we are also positive for all the front-end business (uranium, conversion and enrichment). When I look at the market price of these three components, I conclude that now all suppliers and customers share the same common view that post-Fukushima adjustment is behind us and that a new trend has started.

.jpg)