Centrica has opted out of a joint venture with EDF Energy to build new nuclear power plants in the UK, dealing a blow to the project. Centrica retains its 20% interest in eight operating plants.

Centrica supplies the majority of the UK's gas, as well as about 12% of electricity. It added nuclear to its gas generation and trading businesses in 2008 to help it meet more of its customer's needs from its own generation and reduce wholesale purchases. The 20% holding in current EDF Energy nuclear power plants remains as about one third of Centrica's electricity supply.

Pulling out of the new build joint venture led by EDF Energy, Centrica said that the project had approached an agreed £1 billion ($1.5 billion) limit on pre-development spending. Winding up its involvement and financial commitment, it plans to return surplus cash to shareholders via a £500 million ($786 million) share repurchase program.

"While there has been progress in a number of key project areas, particularly design and planning, there remains uncertainty about overall project costs and the construction schedule," it said. Chief executive Sam Laidlaw added, "These factors, in particular the lengthening time frame for a return on capital invested for a project of this scale, have led us to conclude that participation is not right for Centrica and our shareholders."

Contract for investment

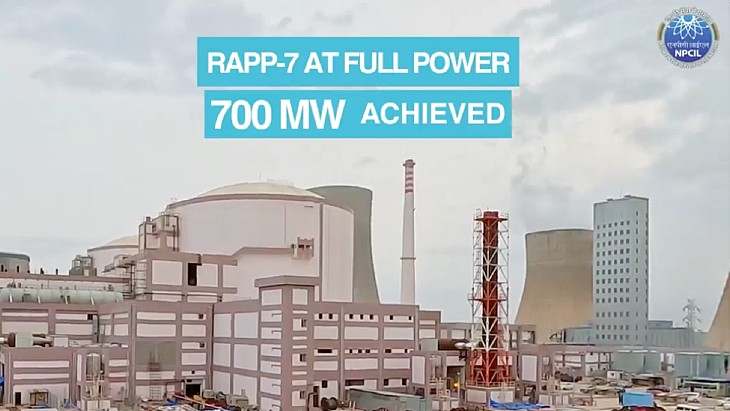

The loss of Centrica is a setback to EDF Energy as it finalises its investment case for the 'shovel-ready' Hinkley Point C project, on which site preparation has already begun. EDF said it was "prepared" for the decision, which had been widely rumoured.

Integral to the economics of new nuclear in the UK is the government's Contract for Difference (CfD) scheme, with which it hopes to encourage and add certainty to low-carbon investment and simultaneously stabilise consumer power prices. This is a major element in energy market reform.

EDF Energy is currently in tough negotiations with government to set the CfD's strike price for nuclear. If market prices for power are below the strike price, then government reimburses the difference to the power company; if market prices are higher, then the power company pays the government.

There will be a strike price for each low-carbon technology, making EDF's role important for every other UK new nuclear project as well. Head of EDF Energy Vincent de Rivaz said that CfD is "more than ever the key to attracting investors and to unlock the funding for [Hinkley Point C]."

He added that a robust agreed price will be the basis for EDF Energy to "finalise discussions with other investors." It has been widely reported by British media to be in discussion with long-term partner China Guangdong Nuclear Power Corporation.

Researched and written

by World Nuclear News